Since January, I’ve been exploring how to do a low buy year and what it’s like. It’s going really well so far. I had various reasons for embarking on this journey as discussed in my previous Q1 Low Buy Update, number one being suddenly catapulted into a sabbatical of unknown duration. While I can’t say that I knew it was not going to happen one day, the timing did catch me off guard. I realised I needed to rein in my overhead immediately, and figured out rather quickly what steps to take. I documented that initial phase, along with the differences between a low-buy and no-buy year in one of my first posts called How to Start a Low Buy Year. Check it out if you missed it.

Over five months have past, and the low-buy year has been a sort of learning-by-doing experience. There’s not a high learning curve to it though, and it’s fairly easy to start at any time of the year. Or for however long you like, be that just a week or a month, or a full year. I plan on continuing bringing you quarterly updates of my progress. In the meantime, I am seeing a growing amount of traffic coming to Tidymalism in search of how to do a low buy year, and wanted to delve into the subject with you again today. How do you do a low-buy year?

There are two big steps to take to make your low-buy year a success. First is identifying your biggest areas of spending. You can do this by assessing your budget, if you have one, or by reviewing your credit card and bank statements. The second step is to define the rules for your personal low-buy year. Rules that you can stick to, and which work for you personally. Let’s take a closer look at these steps, plus a few other things to take into consideration.

Table of Contents

How to Assess Your Spending to Do a Low Buy Year

This is the first big step in embarking on a low-buy year: evaluating what you typically drop your hard-earned money on. If you already use personal finance or budgeting software such as Banktivity, SeeFinance, Mint or the like, this is going to be a fairly easy step.

Open up your programme and create an annual expense report if your software has not automatically generated one for you. Inside this report, go into your spending summary and you’ll see all of the spending categories you track, with a total sum for the year so far. Toggle to the previous year for a comparison.

In all likelihood, you’ll see the usual big expenses at the top of your report such as rent or mortgage, health insurance, and groceries. What else is in your spending summary though? Look for non-essentials—this is where it gets interesting.

My number one spending category, for example, was fashion, followed by cosmetics and travel. You might have similar habits, especially if you’re single like I am. Or you might have expensive hobbies. Or too many insurance policies costing you a tidy sum every year. Dig into your report to get an understanding of where your money goes.

If you don’t use any sort of financial or budgeting software, gather all your bank account and credit card statements from the past twelve months, get yourself a big cup of coffee, and grab a pad of paper and a pencil.

Start with your credit card statements, and go through your big and recurring expenditures to review what spending category they’re coming from. If you are extremely lucky, your bank or credit card company provides you a breakdown of your spending habits right on the statements. In most cases though, it’s just going to be a chronological list of your transactions.

KEEP IT SIMPLE

Don’t over-complicate, especially if you’re doing this manually. Pen and paper are fine. You’re looking for those non-essential categories you tend to drop big bucks in.

“Big bucks” is totally subjective. It might be ten quid for one person, one hundred euros for another, or anything in between, or lower, or higher. You’re not tallying anything up here. You’re just focusing on your spending categories to get a feel for where you spend.

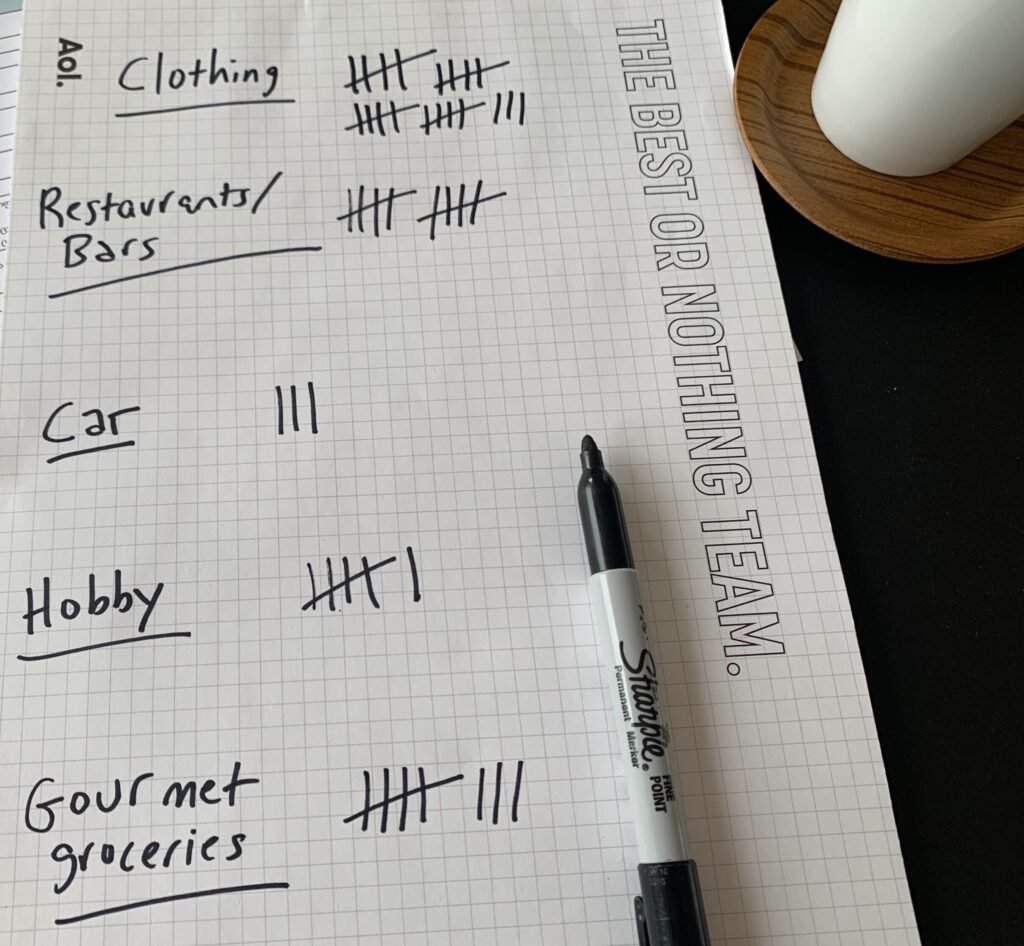

On your pad, make a note of the main categories you see on your statements, e.g. subscriptions, eating out/takeaway, travel, home decor, clothing, automotive, etc. and simply make a tick for every major expense in the respective category.

This method will obviously not give you any total annual spending sums, but you don’t need to know those to do a low-buy year. You really just need to make sure you have a solid understanding of the biggest areas you spend your money in. Once you do, you can move onto the next step.

Identify Spending Categories to Cut Back In

Once you have an overview of what you spend money on, weed out the essential from the non-essential spending categories. Of course, in the area of essential spending there are often also savings to be had. That is, however, perhaps an exercise best left for a rainy day when you can hunt around for more attractive car insurance premiums, for example, or figure out why your grocery bill has exploded. Really focusing on the non-essentials is how to do the low buy year. Be honest with yourself, and keep it realistic.

Now take the areas of discretionary spending you pinpointed in the above step with the help of your statements or software, and have a hard look at them. Which of these areas can you cut back in, or eliminate entirely for a time? Write down these categories.

Mine were fashion, cosmetics, and eating out. Yours might be carshare rentals, decorating, and wellness spas. Or hobbies, gifts, and fitness clubs. Whatever they might be, write them down on your pad once you’ve identified them.

Evaluate Future Costs

Now that you’ve assessed your spending and identified your non-essential spending categories, have a look at what you’ve written down. Do any of these categories potentially contain any upcoming future costs?

Perhaps an annual membership fee for a club you’re in will soon be due. Maybe your favourite pair of running shoes is going to need to be replaced in the autumn, and they cost an arm and a leg. Or your car will need to have it’s regular inspection done. You might realise that you have some redundant annual subscriptions coming up. Or that you’re invited to a huge wedding in September you’ll need to get a fancy gift for.

Some of these future costs might be avoidable. Now is a great time to check for redundancies, things you no longer use such as old software subscriptions, or stuff you’ve lost interest in like a tap dancing class you keep forgetting to cancel.

You could also start keeping your eyes peeled for sales and offers if you know you definitely have an item you’ll need to replace later this year, or a gift to shop for. For all the other extra future costs, doing this review will simply help you mentally and financially prepare for them. You can prepare rules around these expenditures as part of the next step.

How to Define Your Rules for a Low Buy Year

Creating rules for how to do your low-buy year is your next essential step. Your rules are for you only, and you want to keep them concise, yet simple. This way they’ll become ingrained very quickly and you’ll adhere to them as if they were second nature.

Take your notepad where you wrote down your major non-essential spending categories. Have a look again at what those were. Which ones can you trim your spending down in? Or even completely stop spending in?

Highlight those categories. Then define a rule for each of those. Let me give you some examples of how I handled my major areas of spending, and how I came up with some rules.

As mentioned, my biggest personal money pit was in the fashion arena. Since my closet is overflowing anyway, it was easy to formulate a rule for myself: I shall abstain from shopping this year for clothing or accessories.

My only exception is to use some vouchers from Luisaviaroma which I still had, lest they expire. I’m also allowing myself to pick up a bespoke item that was ordered over a year ago, if it ever arrives. But that’s pretty much it. No more browsing online. No more wandering through the shops at weekends out of boredom. I created new habits very quickly to replace the old shopping habits. One of them was to start this blog!

Another area, eating out, had admittedly been rather easy for me to cut back on. Ever since the hard lockdowns we all went through during the pandemic, I had gotten used to not dining out. I decided to make my rule this: I may only get two takeaways per month, and they must be inexpensive.

In a nutshell, work out some rules to go with your highlighted categories, which work for you. A lot of “how to do a low buy year” guides out there say you need to be super strict with yourself and create rigid rules. I say that’s rubbish. Allow yourself some flexibility.

If you know that mani-pedis and massages are your absolute weakness, then don’t deprive yourself entirely of them. It won’t work, and you’ll only feel awful. Scale them back instead. Perhaps you could go only every other week instead of every week.

Do not feel you have to compete with all the financial gurus out there who tell you they’re only spending $5 on gifts and cooking EVERY meal at home. They’re lying!

How to Do a Low Buy Year? Don’t Be Afraid of Messing Up!

That’s how to do a low-buy year in a nutshell. Try to track your spending once you’ve set your rules and that’s basically it. It’s really up to you now, and the rules you’ve laid out for yourself. I’m not an advocate of inconsequential behaviour, but on the other hand, things happen, and we slip up sometimes. So don’t beat yourself up about a moment of weakness, or an unexpected expenditure which might crop up.

I’ve had two pitfalls alone this week as I write this! First the battery in my car was completely dead and needed to be replaced, and then I managed to knock over my favourite Artemide lamp from the nightstand in the middle of the night and had to get it repaired.

These things happen. Go with the flow. Don’t be afraid to mess up. It’s a process. You can always prolong your low-buy year, or tweak your rules to accommodate current circumstances.

If you’re intrigued by the idea of seeing how much money you can save, or what it feels like to scale back your consumer habits, you’re already halfway home. Try out low buying for a week or two, and see how it goes. Doing so will give you a good sense of what your overarching financial goals are, and what you want to achieve.

Even if you decide a low-buy year is not for you, doing a trial phase like this will allow to you discern where you tend to spend most. That’s a valuable exercise in of itself – it arms you with insights for your financial planning in general.

Leave a comment if you have any questions, or if you’re also on a low-buy year like me. Good luck in the meantime!

Check out the entire Low-Buy Series here at Tidymalism!

– How to Start a Low-Buy Year

– Q1 Update

– How to Do a Low Buy Year: Narrowing Down Categories & Creating Rules

– Q2 Update

– Q3 Update

– Planning a Low Buy Challenge for the New Year

– Q4 Update

Leave a Reply